Our Paul B Insurance Statements

Wiki Article

Paul B Insurance - An Overview

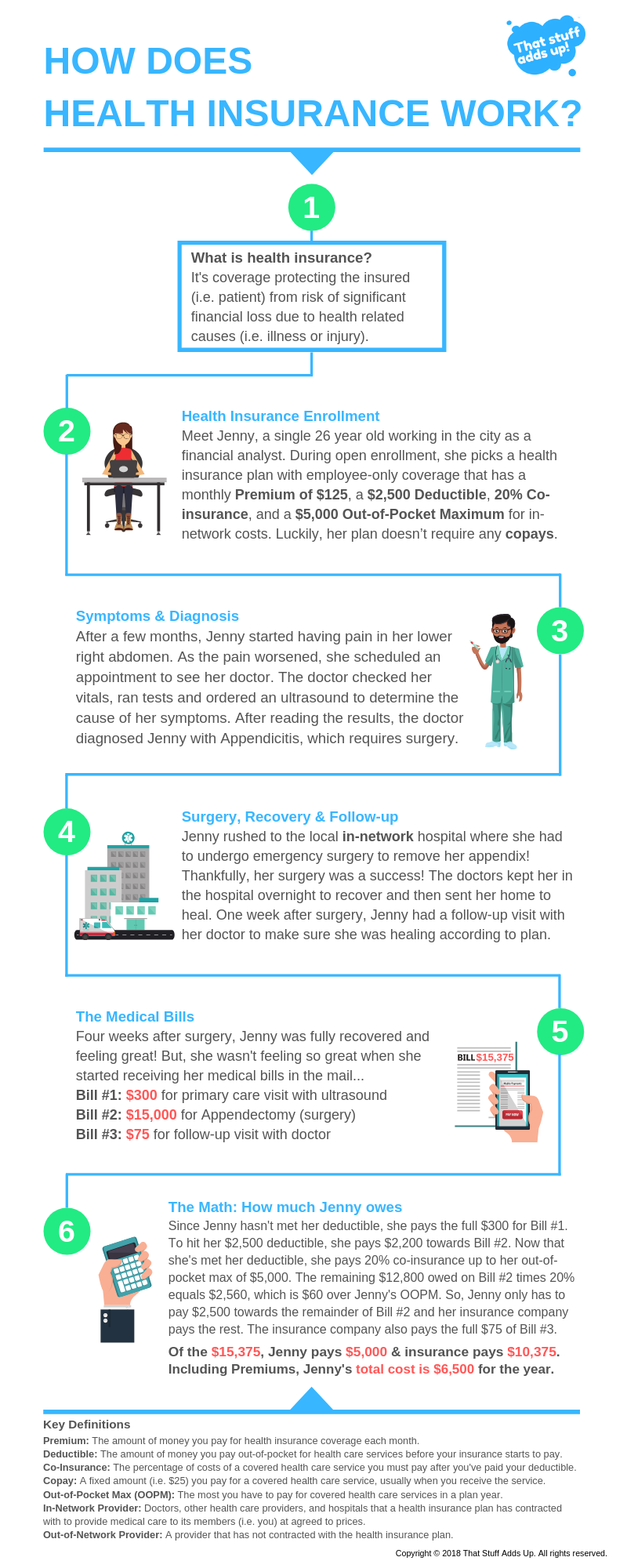

You may have a $10 copay every time you see your primary care doctor or $30 every time you see a professional. Coinsurance is the percentage of the cost that you're responsible for.

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)

The insurance coverage firm pays the remainder. The majority of wellness strategies are called for to cover preventative treatment without any kind of cost-sharing.

You can discover a listing of all the cost-free precautionary care services below. Some strategies that existed before 2010 that have actually not substantially altered-- known as grandfathered strategies-- and also short-term health insurance plan those that offer protection for less than a year-- do not need to give free preventative services.

Call your insurer and ask. If that holds true, your medical professional will certainly give you a reference to the professional you need. The professional may need the referral documentation prior to seeing you in the office, so ensure all the documents is finished. Examine to see if the expert remains in your insurance policy business's network.

Some Of Paul B Insurance

You'll generally have to pay component of the expense for your medications. If it is a long-lasting medicine, you may want to fill a 3-month prescription at once; it is usually more affordable that method than getting monthly refills.

This list is called a formulary. You can discover it online or call your insurance policy business to make certain the drugs prescribed by your doctor are covered. If they aren't, talk with your medical professional concerning comparable medications you might take.

A (Lock A locked lock) or indicates you've safely attached to the. gov web site. Share sensitive information only on official, secure websites.

Your residence's framework is recognized as your dwelling. The total residence protection restriction will cover the costs of fixing or changing the framework of your residence. Insurance coverage for various other frameworks on your residential property - consisting of sheds, barns, removed garages, - are generally covered at a degree equal to 10% of the dwelling protection limit.

Some Of Paul B Insurance

e., boarders or occupants, are not commonly shielded by your residence insurance coverage, unless you have actually organized for this type of protection with your insurance provider. The individual home limit is generally a portion (e. g., 50%) of the residence protection limit. Some insurers might provide better than 50%. You ought to examine to see to it the quantity of protection for your personal effects suffices to cover the loss and also otherwise, contact your insurance policy producer to see regarding raising the limit.

If you want coverage beyond what is covered under your house insurance policy protection, you can explore numerous optional coverage endorsements from your insurance coverage manufacturer or business (see web page 8 for a conversation of the personal effects recommendation). Other home such as pets, electric motor lorries, airplane and also components are not covered under residence insurance coverage plans.

As an example, if your fridge has a 20-year life expectancy and is 17 years old, if it were harmed, the business would not pay to replace the fridge however to pay for what a fridge with only 3 years of efficiency would set you back. Most house insurance coverage cover the materials of your residence on a real money value basis.

The premium will certainly be slightly greater for this coverage; however, you may want to consider this choice. Substitute expense is the amount of money it would take to change or restore your house or fixing damages with materials of similar kind and quality, without subtracting for depreciation. Several insurance companies need house owners to guarantee their homes for at the very least 80% of the replacement price as well as some may call for 100%.

The Best Guide To Paul B Insurance

Thinking (1) it would set you back $200,000 to change your house, (2) it is insured for $160,000 (80% of its replacement worth), (3) you do not have an insurance deductible on your plan and (4) a fire creates $40,000 well worth of damage, then your insurance business will certainly pay $40,000 to fix the expense of the claim at the substitute cost under the policy.

And some airlines need that the case be submitted within 21 days. To make matter worse, DOT does not specify when baggage is formally lost (as opposed to simply "postponed").

Unexpected circumstances occur, as well as you desire to be covered just in case. Some debt cards offer limited coverage, with annual restrictions and also restrictions for cancellations as well as disturbances (if they offer cancellation/interruption coverage whatsoever). However, few charge card provide insurance coverage for the most expensive travel risks: medical expenses or emergency situation discharges, which travel insurance policy can cover.

Traveling insurance cost is largely based upon the rate of the journey and also the age of the vacationer. A 35-year-old could anticipate a plan to add 3% to 5% to the cost of a journey while a 60-year-old may pay around 10%, says Jonathan Harty, proprietor of a MA-based holiday company.

Unknown Facts About Paul B Insurance

You can occasionally buy this as a standalone policy or as a motorcyclist on an extensive plan. This is the common policy that individuals think of when they think about journey insurance coverage. The comprehensive policy generally covers hold-ups, termination due to sickness or death, shed travel luggage and also some emergency situation medical expenses.

When booking a pricey trip, explore insurance at the same time. Some policies require you get traveling insurance within a specific quantity of time after making your preliminary journey settlement, such as within 10 to 30 days.

Going on a journey must be an amazing experience. While termination as well as various other issues create anxiety, you can take the monetary fear from it by getting your trip insured.

Automobile insurance is a necessity because vehicle drivers take the chance of triggering numerous thousands of dollars in damages each moved here time they drive. As a matter of fact, Purse, Hub notes that uninsured vehicle crashes and also disasters are just Get More Information one of the leading 3 sources of personal bankruptcy, along with job loss and clinical expenses. Cars and truck insurance policy minimizes this danger, so drivers do not need to pay for costly damages.

The 20-Second Trick For Paul B Insurance

Clinical payment coverage, required by some states, pays your clinical bills after a mishap, despite fault. Crash insurance coverage is an optional plan that pays for repair web services to your car despite mistake, according to The Hartford. Extensive insurance coverage is an additional optional policy that covers non-collision insurance claims such as climate damage, theft, or vandalism.

The insurance company will examine this report carefully when exploring your claim. Take notes that cover all the details of the mishap.

Report this wiki page